Jeffrey Jin , co-founder of Elixir Biotech Real Estate talks about 4 key trends in China life science shaping a robust real estate opportunity.

Rising Demand

Despite China has 1bn population and an aging population, life science in China is a young industry. Only few years of development history and at its early stage of development.

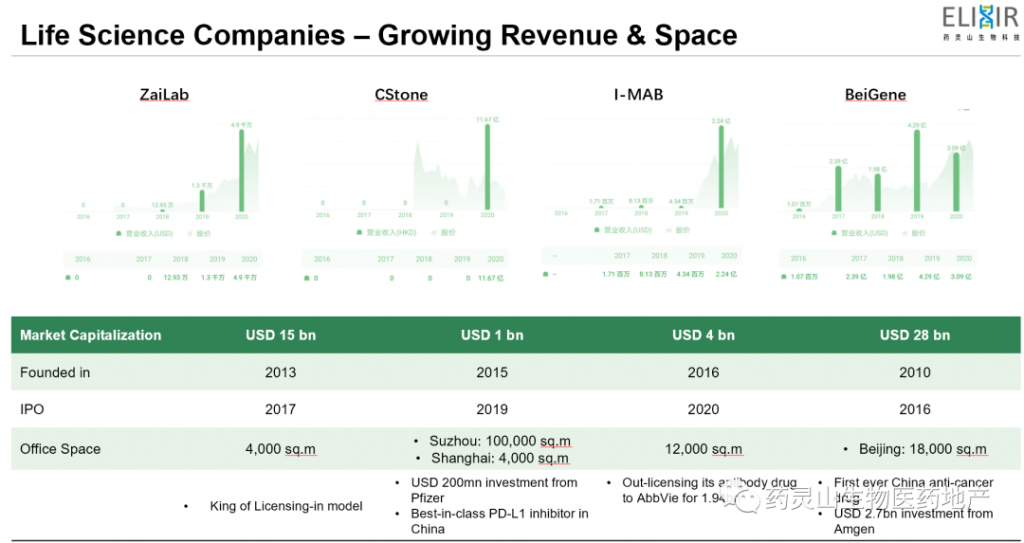

Boosted by policy, capital and talents , biotech industry undergoes a tremendous gowth in recent years. We are seeing a big jump in registered no of biotech companies and employment figures in the industry . This growth is very rapid. This trigers the new demand for biotech infrastructure facilities such as labs and R&D office, and speciliased biopharma manufacturing plants. We are seeing a trend that this growth in demand for space replicates the growth in life science industries.

Premier Rent

The market is in under-supply situation to meet the demand. A project in Zhangjiang after repositioning to life science park, rent gone up to 7 rmb, vs grade A office rent 5 rmb. A premium rent for life science properties

There is another recent case in Zhangjiang south , the area is normally rent out at 2-3 rmb/day, but the building becuase it is life science enabled rent achieve at 4-5 rmb.

We are seeing trend No 2, life science properties not only can rent it out faster , and but also charge a better rent. The strong demand and undersupply situation could make things even worse for tenants in some location like Zhangjiang.

Emerging Asset Class

If you look at the current status of major life science park in China, most of it are owned by the government companies and end-users. Many of these existing facilites are also out-dated, There are not many Class A life science park around. The Government post strigent rules on how companies are selected as tenants.

We are seeing this operation is not efficient from both land use .and user demand perspective. If you look for building your lab and manufacturing operation , you ask the government for space, and the govt ask you how much tax you can generate. We think there is a misalignment of resources here. There is an opportunity for us to bridge the gap.

Growing Capital

The recently established China reits market is embracing the life science properties as a new asset class. More capital is deploying into this sector. We are seeing more transactions.

Life science properties are infrastrusture to support the growth of the life science industry. We are seeing innovation is driving this growth. We also see a trend that break away from tradition in how we develop, operate and manage the real estate side of the business.